Bitcoin Back Below Key Level - Bearish Risks Building

Bitcoin Backs Off Again

Following a recovery bounce yesterday, BTC has come back under fresh selling pressure today with the futures market turning back below the $108,855 support. This is a worrying development for Bitcoin bulls. If price closes below the level today, this could pave the way for a furtehr losses with the 4100k mark the clear target for bears.

ETF Outflows Continue

The latest ETF data shows that institutional flows have continued to move out of Bitcoin this week. Despite the bounce yesterday, a further $40 million in net-outflows were seen, marking a fourth consecutive day of ETF outflows for Bitcoin. Monday’s outflows were driven by heavy exodus of capital from BlackRock’s IBIT which saw over $100 million in outflows. Given that BlackRock has been the main name in the BT ETF space, attracting the most investment, volatility like this is to be expected but is still a worrying sign for bulls especially if outflows persist.

Institutional/Retail Demand

The disparity between spot BTC ETF flows and futures price action shows the lag that occurs sometimes when derivatives pricing reacts more instantly to shifts in market sentiment. This also highlights the variability between institutional and retail flows. As such, trends in ETF flows are more reliable as a signpost for BTC price action rather than daily shifts. However, given that we’ve seen 4 days of outflows, the overall signal here is a bearish one, reflected in the weaker price action we’re seeing today and the growing risks of a fresh move lower in BTC if we close sub $108,855 today.

Technical Views

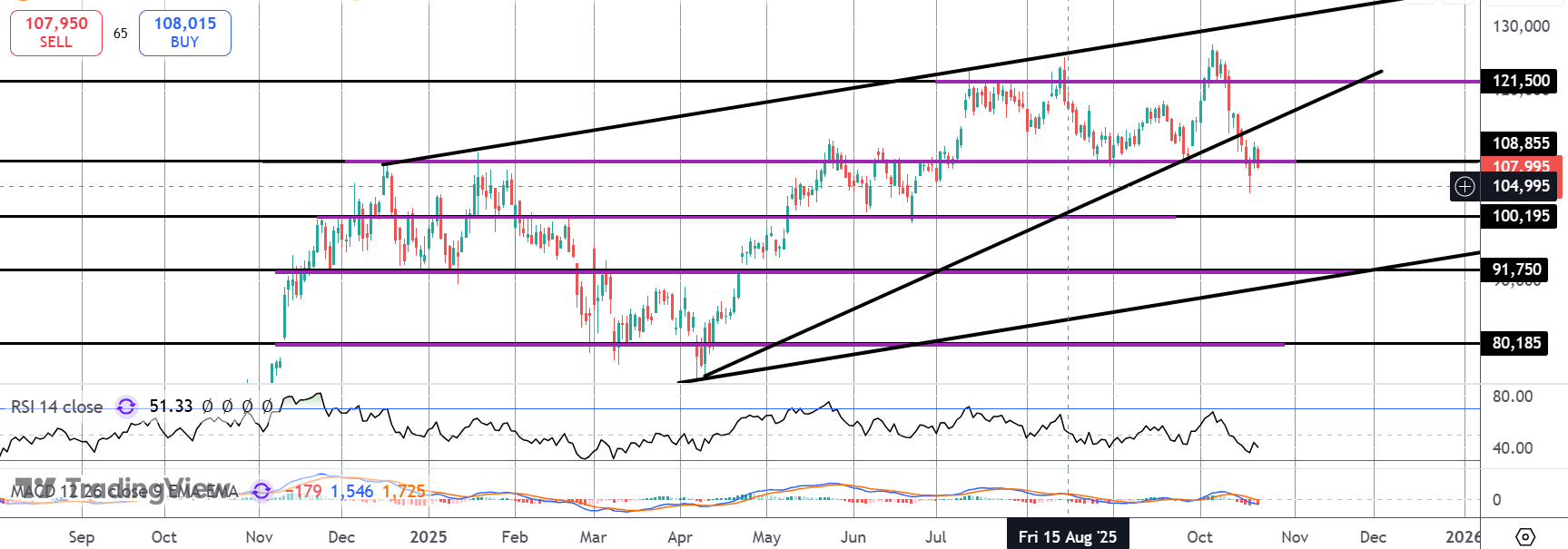

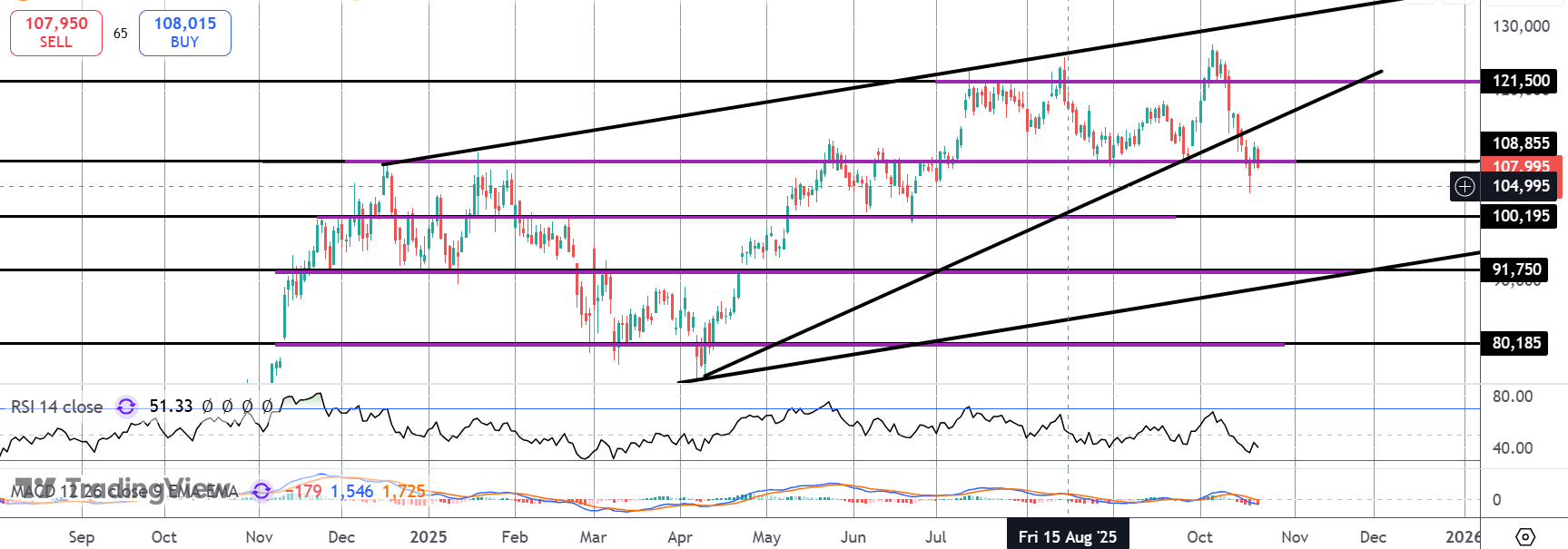

BTC

The sell off in BTC has seen price breaking below the bull trend line from YTD lows and below key support at the $108,855 level. If price holds below this level, a test of deeper support at the $100k mark looks likely near-term, particularly with momentum studies weakening now.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.