Bitcoin Stabilises Following Crash Lower

What’s Driving Bitcoin?

Bitcoin prices are bouncing back today from fresh YTD lows after the futures market gapped lower at the open, extending Friday’s sell-off. BTC remain down sharply from the initial January highs which now amount a false range-break and signal risks of a deeper push lower. Volatility in risk sentiment in recent weeks has weighed on BTC sentiment and near-term it’s hard to see what can act as a driver for a fresh bull run. A dovish surprise from the Fed from the Fed this week could possible help revive appetite. However, with gold prices seeing explosive gains, and some decent moves in FX markets, Bitcoin is lacking excitement and appeal currently meaning that we could well drift lower and retest those November lows before we start to see any proper recover higher.

Huge ETF Outflows

Bitcoin’s recent loss of appeal is best reflected in the latest ETF data which shows huge outflows from BTC ETFs. Combined funds saw outflow of just over $1 billion last week, marking the biggest exodus of capital since November 2025. Those outflows in November were accompanied by heavy futures losses, signalling bearish risks for BTC near-term. Indeed, crypto funds have seen outflows generally with total AUM for crypto funds now down to $178 billion from $193 billion a week prior. While this dynamic continues, BTC could well push lower in coming weeks.

Technical Views

BTC

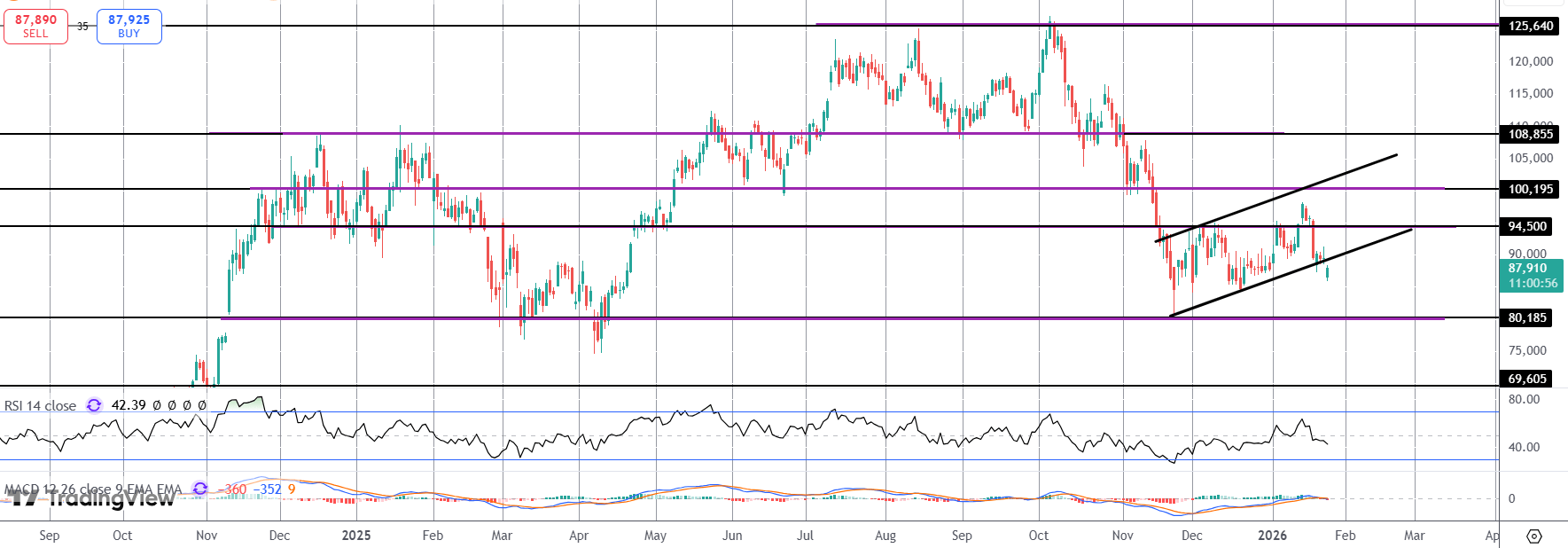

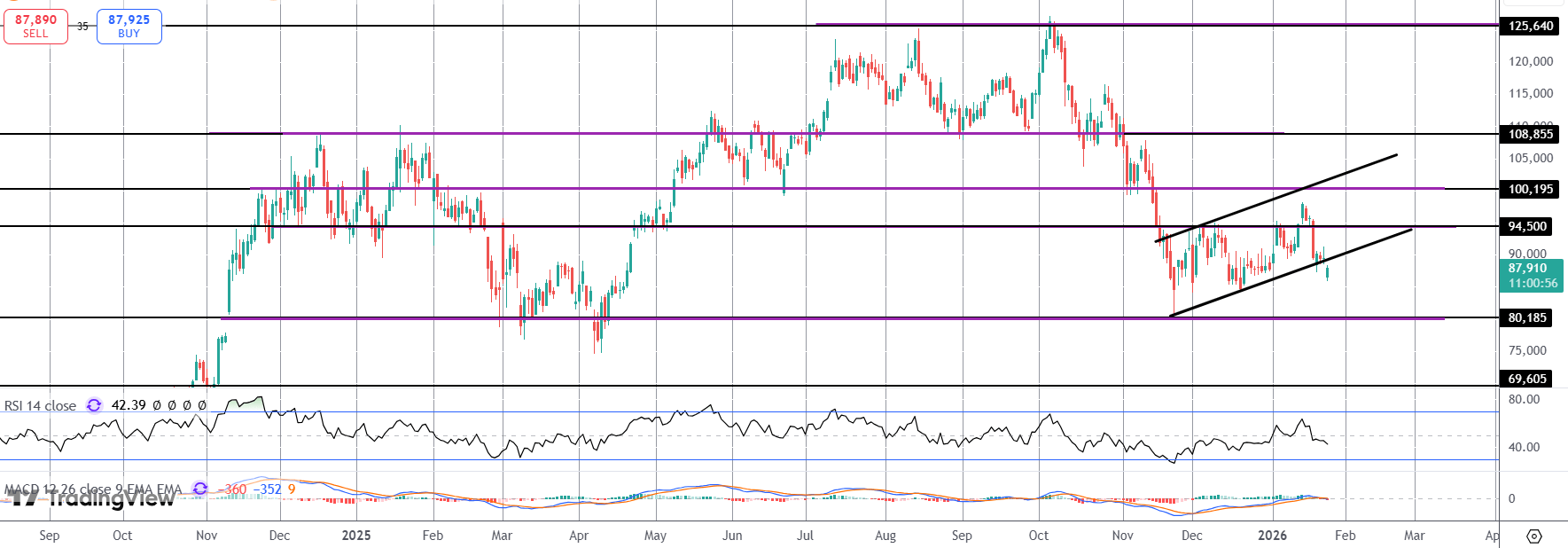

The sell off in BTC has seen the market breaking down below the corrective bull channel off November lows. This can be seen as a bear flag break, signalling risks of a fresh push lower with the $80,185 level the first support to note ahead of $69,605 as the deeper bear target. Topside, bulls need to clear $100k to shift momentum back in their favour.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.