Dollar Dumped On Dovish Powell Comments

Dovish QT Comments

The US Dollar has come under fresh selling pressure today on the back of dovish remarks from Fed chairman Powell yesterday. Powell warned that the Fed is nearing the point where it will stop scaling back the size of its bond purchases. The reduction of bond purchases, known as quantitative tightening, has been an underpinning bullish factor for USD, signalling that the Fed remains in hawkish territory. On the back of the recent rate cut, however, and with further easing expected this year, news of the shift has been taken as a clear dovish signal with USD sold accordingly. Though no clear timing signal was given on when the shift will take place, Powell said that such a move might become appropriate in the coming months.

Powell on Rates

Elaborating on interest rates, Powell warned that the bank has been in a tricky place due to the resilience in inflation data and the strength of the labour market through much of the year. However, Powell explained that since July, the labour market has weakened considerably, bringing the two risks (jobs weakness and inflation strength) closer in line with one another. As such, the Fed is in a position now where its monetary policy approach is becoming clearer. Indeed, Powell noted risks to the jobs market have risen, putting greater pressure on the Fed to ease. On the back of these comments, USD looks vulnerable to further downside this week as traders ramp up easing expectations through year end.

Technical Views

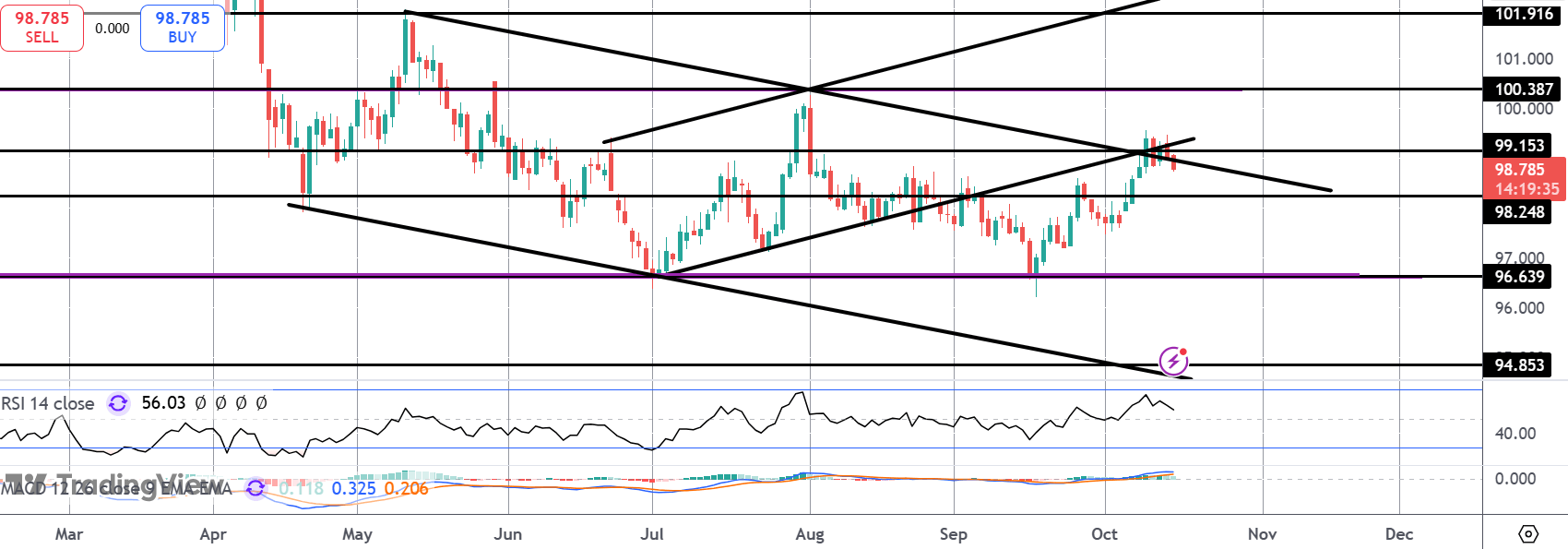

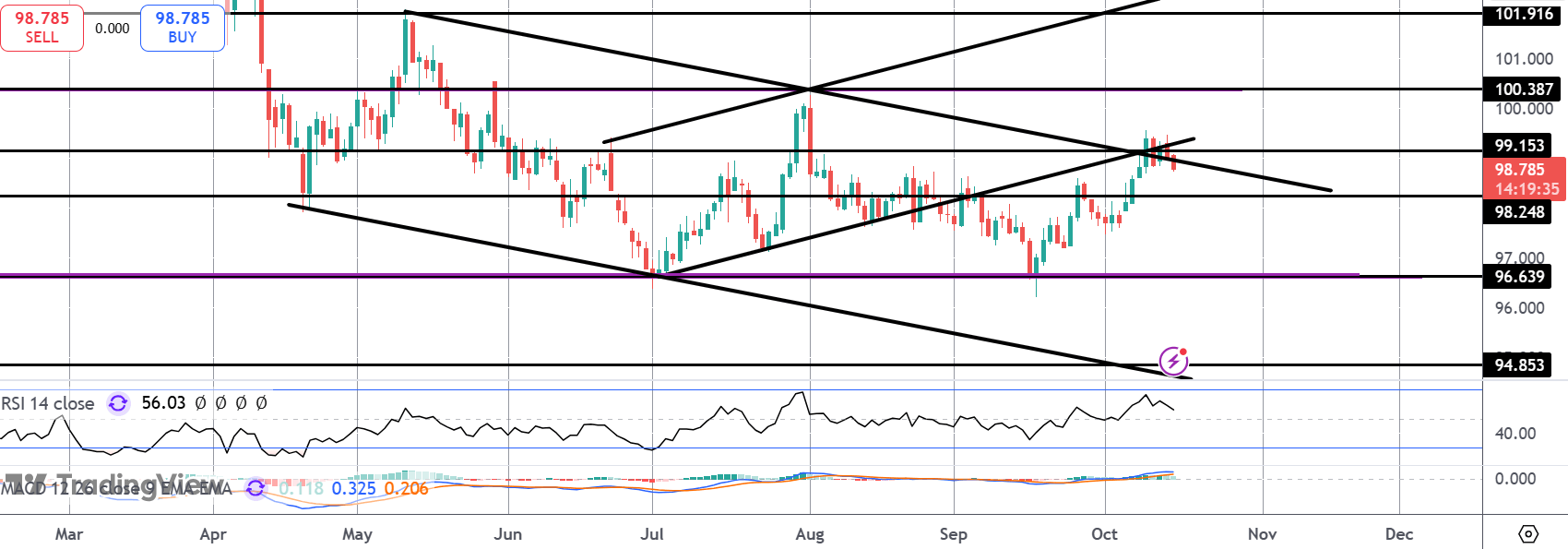

DXY

The rally in DXY off the September lows looks to have stalled for now into the 99.15 level. Price has now turned back inside the broken bear channel and while back under trend line resistance, focus is on a furtehr correction lower. 98.24 will be next support to watch.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.