USDJPY Plunges On JPY Safe-Haven Demand

USDJPY Decline Deepens

The sell off in USDJPY continues ahead of the weekend as safe-haven JPY continues to draw support amidst a weakening of risk assets this week. Fresh trade threats between the US and China ahead of the upcoming November 10th trade deadline have rocked risk markets this week. Following Trump’s threat of 100% tariffs on Chinese goods (last Friday) risk assets have been in free fall driving a spike in safe-haven demand for gold and JPY. Meanwhile USD has remained under selling pressure as traders brace for fresh easing from the Fed this month and continue to view further rate cuts ahead of year end.

US/China Trade Hostilities

On the trade front, the US has accused China of fresh trade aggression after it announced new controls on rare earth exports last week. In response, Trump threatened to hit China with 100% tariffs on Nov 10th when the current trade-tariff suspension lifts. China has so far not backed down and warned that it will retaliate against any measures from Trump. With the deadline fast approaching, risk markets are tumbling as traders eye the return of elevated tariffs between the two countries. If tariffs are lifted on Nov 10th and no extension or deal is agreed, JPY looks set to gain further as risk markets crash further. However, if tensions start to ease and it looks as though a deal is coming, safe-haven demand should soften as risk markets recover. Still with Fed easing expectations also in the picture, USDJPY could remain soft into year-end barring any dovish shift in tone from the BOJ.

Technical Views

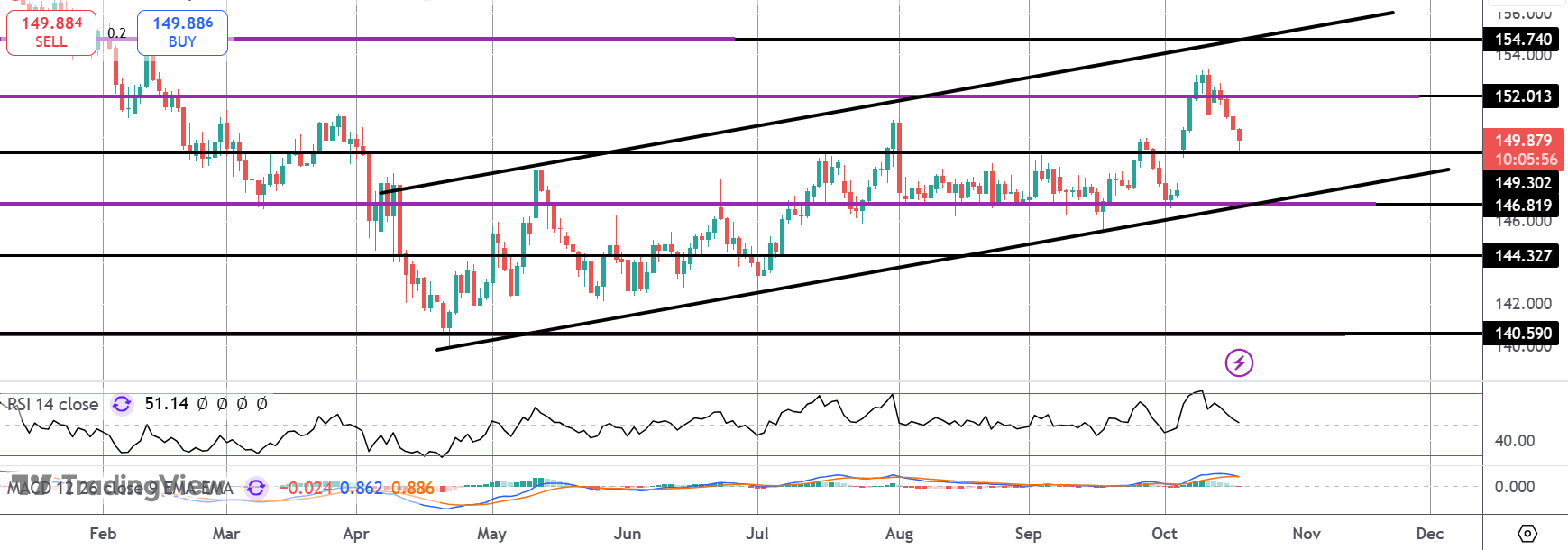

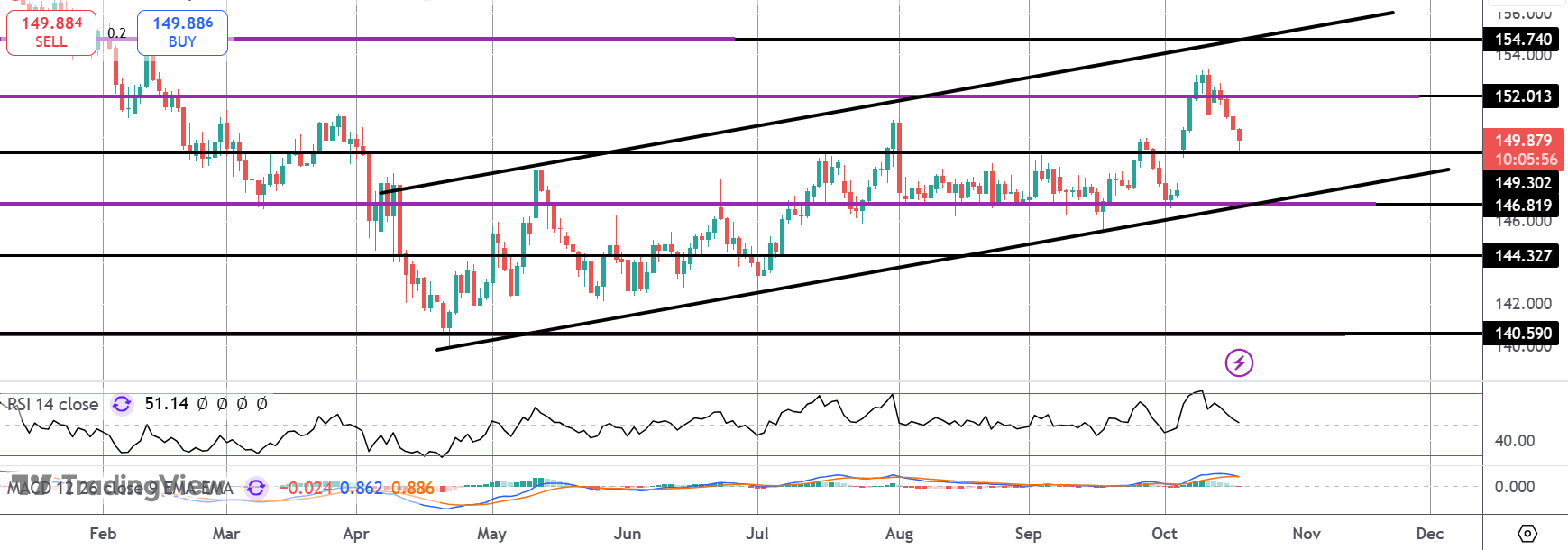

USDJPY

The pair continues to correct lower within the bull channel which has framed the recovery this year. Price is now testing the 149.30 level and with momentum studies falling fast, risks of a deeper push are growing. Belo where, the 146.81 level and bull channel lows will be the key level to watch with bulls needing to defend that zone to prevent risks of a deeper reversal forming.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.