SP500 LDN TRADING UPDATE 25/11/25

SP500 LDN TRADING UPDATE 25/11/25

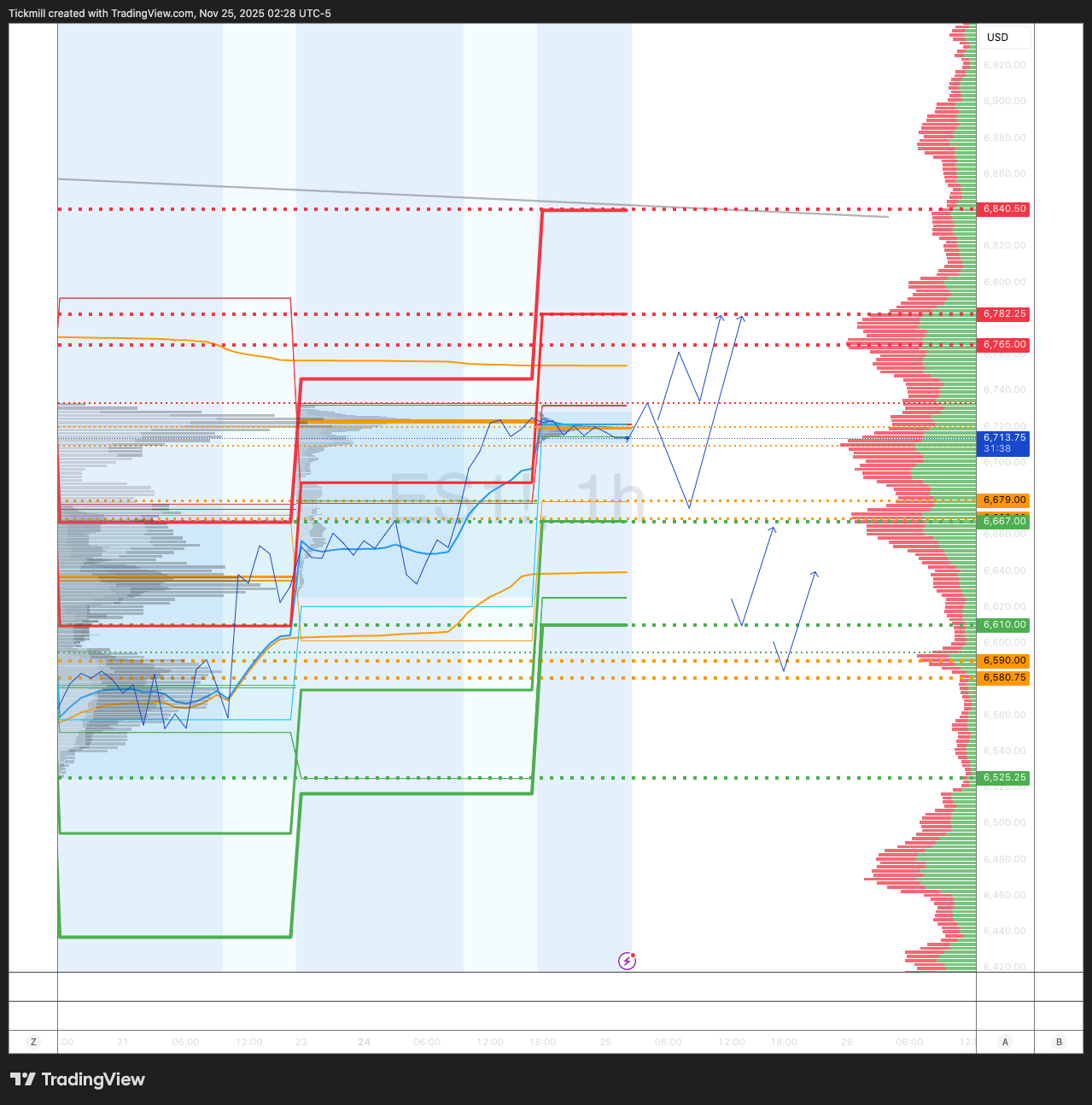

WEEKLY & DAILY LEVELS

***QUOTING ES1! FOR CASH US500 EQUIVALENT LEVELS, SUBTRACT POINT DIFFERENCE***

WEEKLY BULL BEAR ZONE 6590/80

WEEKLY RANGE RES 6765 SUP 6475

NOV EOM STRADDLE 7054/6626

DEC QOPEX STRADDLE 7025/6303

DAILY STRUCTURE – BALANCE - 6709/6594

DAILY BULL BEAR ZONE 6679/69

DAILY RANGE RES 6782 SUP 6667

2 SIGMA RES 6840 SUP 6610

DAILY VWAP BULLISH 6627

VIX BULL BEAR ZONE 22.2

TRADES & TARGETS

LONG ON ON REJECT/RECLAIM DAILY BULL BEAR ZONE TARGET DAILY RANGE SUP

SHORT ON TEST/REJECT WEEKLY/DAILY RANGE RES TARGET 6732

(I FADE TESTS OF 2 SIGMA LEVELS ESPECIALLY INTO THE FINAL HOUR OF THE NY CASH SESSION AS 90% OF THE TIME WHEN TESTED THE MARKET WILL CLOSE ABOVE OR BELOW THESE LEVELS)

GOLDMAN SACHS TRADING DESK VIEWS

U.S. EQUITIES COLOR: MO’ SNAPBACK

S&P rose +155bps, closing at 6,705 with a Market on Close (MOC) imbalance of $5.3bn to SELL. NDX surged +262bps to 24,874, R2K climbed +188bps to 2,414, and the Dow edged up +44bps to 46,448. Trading volume reached 18.8 billion shares across all U.S. equity exchanges, exceeding the year-to-date daily average of 17.53 billion. The VIX dropped -12.3% to 20.52, WTI Crude advanced +152bps to $58.95, the U.S. 10-year yield fell -3bps to 4.03%, gold gained +165bps to 4,132, the DXY rose +1bp to 100.19, and Bitcoin increased +121bps to $89,030k.

U.S. equities rallied sharply today, marking the best session for the NDX since May, as the probability of a December rate cut climbed to 80% following dovish comments from Fed officials (Collins, Daly, Waller) ahead of the blackout period starting Saturday. Liquidity and activity levels were subdued, suggesting reversionary trading (possibly short covering) amid holiday week dynamics. Momentum rebounded +6%, with tech heavyweights (AVGO, TSLA, GOOG) accounting for over 50% of NDX gains. The S&P Equal Weight index underperformed by ~1%, while the SPX closed just shy of its 50-day moving average at 6,713.

Economist Hatzius noted that the delayed September jobs report likely solidified expectations for a 25bp rate cut at the December 9/10 FOMC meeting. Fed official Williams emphasized the need for “a further adjustment in the near term,” citing increased downside risks to employment and reduced upside risks to inflation. This view aligns with Powell’s stance. With the next jobs report scheduled for December 16 and CPI data on December 18, there appears to be little on the calendar to derail a December 10 rate cut.

Market activity was modest, scoring a 3 on a 1-10 scale. Our floor rose +431bps to buy, compared to the 30-day average of -205bps. Flows were benign, with long-only investors (LOs) remaining flat and hedge funds (HFs) net buyers by $1 billion, with broad demand across tech, healthcare, and industrials. Healthcare showed notable strength, particularly in exchange-exposed names like OSCR (+22%), CNC (+5%), and MOH (+3%), as well as hospital stocks THC (+12%) and HCA (+3%), following reports of a White House push for a two-year extension of ACA enhanced subsidies. After-hours, ZM gained +4% after beating earnings expectations and raising guidance, leaving the stock flat year-to-date.

Earnings activity picks up tomorrow with reports from BURL, DKS, SJM, ANF, BBY, and URBN. Last week, both discretionary and staples sectors outperformed while AI/tech traded lower. Our prime team highlighted that discretionary saw the largest net dollar buying in two years, while staples experienced the most significant net dollar selling in 15 months. Hedge funds and long-only investors had reduced discretionary exposure in Q3, bringing it to multi-year lows.

In derivatives, volatility compressed significantly across assets and expiries, with skew softening broadly. The front-end curve remains inverted, but the most notable move was the sharp decline in gamma earlier in the session. NDX spreads, which had been trading above 7 in the front, returned to their typical range despite spot outperformance, reflecting prior stretched levels. Flows were muted but leaned toward forward vol buying, given attractive pricing early in the day. The desk prefers a flatter vol stance, favoring call and put spreads for directional plays over outright short vol structures.

The implied move through November 28 is 1.21%, reflecting liquidity constraints during the holiday week (S&P Top of Book sits just below the 6th percentile on a two-year lookback). The SPX closed just below the CTA short-term threshold level (6,707), which, if crossed, could alleviate systematic selling pressure. (Thanks to Gail Hafif for insights.)

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!